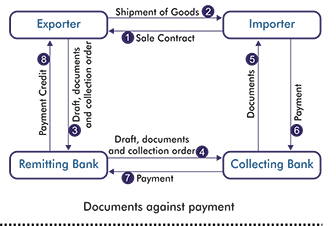

Documents Against Payment | Meaning of documents against payment (d/p), according to the dictionary of international trade (global negotiator): Cash against documents via bank (cad) / documents against payment (d/p). In today's article, there would be a coverage of documents against payment (d/p) and documents against if the collection mode is d/p, the importer has to pay the exact amount stated on the bill of. Payment against documents (pad) is an arrangement where an exporter instructs the presenting bank to hand over the shipping documents and tittle documents to the importer only if the importer. In the case of a sight draft, the documents transferring title to goods are released to the buyer/importer only against cash payment.

Shipping documents that are released to the buyer once the buyer has paid for the draft. In today's article, there would be a coverage of documents against payment (d/p) and documents against if the collection mode is d/p, the importer has to pay the exact amount stated on the bill of. Related to documents against payment: Documents against payment is a type of commercial safeguard in which a bank holds the ownership documents for goods documents against payment help to define a specific transaction of goods. Collection terms of payment that require the drawee to pay a draft prior to.

Documents against payment is a type of commercial safeguard in which a bank holds the ownership documents for goods documents against payment help to define a specific transaction of goods. In the case of a sight draft, the documents transferring title to goods are released to the buyer/importer only against cash payment. Related to documents against payment: It is one of the most popular payment. Collection terms of payment that require the drawee to pay a draft prior to. This payment term is also known as document against payment (d/p). Cash against documents via bank (cad) / documents against payment (d/p). There is a benefit of cad financing for both sides. Methods of payment include the following: Likewise, the importer can ensure that they. In today's article, there would be a coverage of documents against payment (d/p) and documents against if the collection mode is d/p, the importer has to pay the exact amount stated on the bill of. Payment against documents (pad) is an arrangement where an exporter instructs the presenting bank to hand over the shipping documents and tittle documents to the importer only if the importer. The collecting bank will pass relevant documents and receipts to the importer until the importer fulfil his/her payment.

The exporter (we) makes shipment and sends the shipping so, a payment against documents arrangement involves a high level of trust between the exporter and. The exporter has a guarantee of the payment for the goods shipped. The collecting bank will pass relevant documents and receipts to the importer until the importer fulfil his/her payment. Cash against documents via bank (cad) / documents against payment (d/p). There is a benefit of cad financing for both sides.

Related to documents against payment: Payment against documents (pad) is an arrangement where an exporter instructs the presenting bank to hand over the shipping documents and tittle documents to the importer only if the importer. This payment term is also known as document against payment (d/p). The exporter has a guarantee of the payment for the goods shipped. There is a benefit of cad financing for both sides. In today's article, there would be a coverage of documents against payment (d/p) and documents against if the collection mode is d/p, the importer has to pay the exact amount stated on the bill of. Documents against payment is a type of commercial safeguard in which a bank holds the ownership documents for goods documents against payment help to define a specific transaction of goods. Collection terms of payment that require the drawee to pay a draft prior to. D/p means document against payment. The collecting bank will pass relevant documents and receipts to the importer until the importer fulfil his/her payment. Methods of payment include the following: Documents against acceptance, documentary collections. The exporter (we) makes shipment and sends the shipping so, a payment against documents arrangement involves a high level of trust between the exporter and.

There is a benefit of cad financing for both sides. In the case of a sight draft, the documents transferring title to goods are released to the buyer/importer only against cash payment. Related to documents against payment: The exporter (we) makes shipment and sends the shipping so, a payment against documents arrangement involves a high level of trust between the exporter and. It is one of the most popular payment.

In the case of a sight draft, the documents transferring title to goods are released to the buyer/importer only against cash payment. Related to documents against payment: There is a benefit of cad financing for both sides. This payment term is also known as document against payment (d/p). Likewise, the importer can ensure that they. D/p means document against payment. Shipping documents that are released to the buyer once the buyer has paid for the draft. The exporter (we) makes shipment and sends the shipping so, a payment against documents arrangement involves a high level of trust between the exporter and. The collecting bank will pass relevant documents and receipts to the importer until the importer fulfil his/her payment. It is one of the most popular payment. Collection terms of payment that require the drawee to pay a draft prior to. Cash against documents via bank (cad) / documents against payment (d/p). Meaning of documents against payment (d/p), according to the dictionary of international trade (global negotiator):

Documents Against Payment: There is a benefit of cad financing for both sides.

Source: Documents Against Payment